Objectives of the research

This study set out to assess the long-term economic risks of insufficient public infrastructure investment in Canada. Using a 50-year modelling horizon to 2060, it examined how both the level of overall spending and the balance between new construction and maintenance affect GDP, real after-tax wages, and corporate profitability. The work reframed the concept of an “infrastructure deficit” from an abstract accounting measure into a question of national prosperity and household well-being.

Core themes that run through the report

- Underinvestment threatens growth. Continuing current trends would lower average GDP growth by roughly 1% per year over five decades, leaving a substantial economic gap by 2060.

- Maintenance is pivotal. Boosting both the size of investment and the share devoted to upkeep moves the economy away from a risky downslope and onto a stable plateau of stronger productivity.

- Predictability matters. Stop–go cycles diminish returns. To achieve the same growth under volatile funding requires much higher average spending, and some growth rates become unreachable.

- Housing depends on infrastructure certainty. Reliable housing supply hinges on infrastructure strategies that endure beyond political cycles.

- Returns are widespread and cost-effective. Even after accounting for higher taxes to finance investment, taxpayers come out ahead—gaining about $1.48 in after-tax wages for every $1 contributed—while firms avoid long-run erosion of net profits.

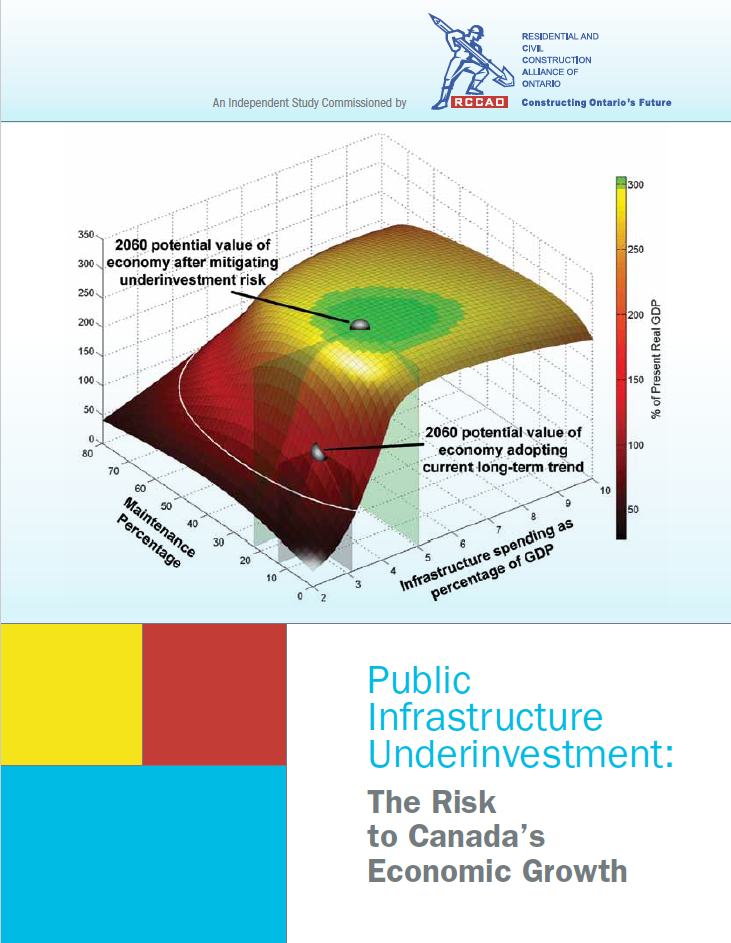

Specific risks of underfunding, and the slippery slope

The report’s 3D analysis shows that the prevailing investment rate (about 3.1% of GDP) places Canada on a precarious slope, where small cutbacks or misallocation trigger outsized losses. Shifting to a stable, adequately funded plan places the economy on a safer plateau. Main exposure channels include:

- Sensitivity of GDP: At today’s levels, growth is highly vulnerable to changes in spending. Correcting course requires ~62% more investment overall, including nearly tripling maintenance.

- Household prosperity: Workers would miss out on roughly 0.5% annual income growth, equivalent to $18,000 in present value terms on average, and up to $51,000 for younger generations.

- Business competitiveness: Firms forgo nearly 0.7% in annual profit growth—about 3% over a decade, rising to 20% over half a century.

- Volatility penalty: Unstable policies reduce growth for any given spending rate and force governments to spend more just to hold ground. This uncertainty reverberates through housing markets, where lack of clarity on enabling works and servicing deters private developers

Infrastructure uncertainty and housing implications

A durable, long-term infrastructure plan is the precondition for a dependable housing pipeline. Without it, project sequencing falters, responsibilities collide across governments, funding ebbs and flows, and private builders hesitate. With it, a reinforcing chain reaction emerges:

- Engineering-led sequencing is upheld. Core systems—water, wastewater, stormwater, energy, transit—are delivered in the correct order through coordinated planning.

- Vertical alignment is achieved. Municipal, provincial, and federal policies reinforce one another instead of working at cross-purposes.

- Funding is stabilised. Multi-year, role-aligned transfers safeguard asset condition and pre-fund enabling capacity.

- Private markets respond decisively. Builders invest their own capital, accelerate delivery, and innovate with confidence.

- Short-term subsidies lose relevance. Governments no longer need ad hoc, politicised incentives to stimulate uncertain markets.

Policy implications the report advances

- Commit to a stable, long-term plan with lifecycle management. Target investment at about 5% of GDP, with 22–23% dedicated to maintenance, and prioritise predictability.

- Elevate maintenance. Proper upkeep slows depreciation and protects productivity, while deferred repairs impose higher costs later.

- Institutionalise stability. Multi-year, predictable funding avoids the waste associated with volatility and better translates into growth.

- Communicate through relatable outcomes. Framing policies in terms of wages, profits, and competitiveness builds public and business support for sustainable investment.

Download Report: RCCAO_Report_JULY2010_LOWRES